Inside the trillion-dollar scramble, China’s infrastructure advantage, and OpenAI’s quiet plea for a bailout.

Discover why the AI boom may already be unraveling. Explore OpenAI’s trillion-dollar infrastructure gamble, Nvidia’s lobbying fallout, and China’s efficient AI strategy.

TL;DR

The $1.4 trillion AI boom may be inflating into a taxpayer-funded bust.

OpenAI is signaling the need for a federal backstop after pledging trillion-dollar infrastructure spending with limited revenue. Nvidia, after supporting U.S. sanctions that cut off its China business, is now lobbying for subsidies. Meanwhile, China is winning with smaller, more efficient, open-source AI models that use less power and cost less to operate.

Key points:

- U.S. AI firms are shifting financial risk to the public through lobbying and subsidy demands

- China’s infrastructure-led, model-efficient strategy is proving more resilient

- The U.S. grid is under strain, and public resources are being redirected to protect Big Tech

- The AI bubble could deflate slowly, but the long-term damage—economic and geopolitical—is already underway

Bottom line:

Big Tech wants profits on the way up, bailouts on the way down. Taxpayers may soon be left holding the bag.

What if the $1.4 trillion AI boom collapses—and your tax dollars are the only thing keeping it alive?

OpenAI is quietly preparing for a federal bailout. Nvidia, after lobbying to kill its own China revenue, now begs for subsidies. And the U.S. power grid? It’s already buckling under the weight.

The demos dazzle. The valuations soar. But beneath the hype, the cracks are spreading—and the bill is coming due.

The Bubble Nobody Wants to Name

The AI sector is moving fast—too fast. Infrastructure is being built faster than monetization can catch up. Investment is outpacing utility.

Key signals of an AI bubble:

- Valuations: Price-to-earnings ratios exceed dot-com levels [Bloomberg].

- Failure rates: 95% of enterprise generative AI pilots show no ROI [Gartner].

- Market imbalance: Buffett Indicator surpasses 220% [Wilshire].

- Circular capital: OpenAI, Nvidia, Microsoft recycle money in closed loops.

This isn’t just exuberance. It’s a strategic misfire—with public dollars now positioned to absorb the impact.

OpenAI’s $1.4 Trillion Infrastructure Gamble

OpenAI has committed $1.4 trillion to AI infrastructure over the next eight years [Reuters].

To put that in context:

- Projected annual revenue: ~$20 billion

- Spend-to-earnings ratio: 70:1

The strategy:

- Centralize control

- Take on massive risk

- Seek federal backstop to cover the downside

Altman denies bailout plans. But the CFO’s signal is unmistakable: they want taxpayer insulation.

Nvidia’s Self-Inflicted Wound

Nvidia lobbied for export bans on AI chips to China. Result:

- Lost access to a $30B+ market

- Now seeks U.S. subsidies (via CHIPS Act) to maintain edge

This is the feedback loop:

Restrict market → Shrink revenue → Lobby for subsidy

It’s not about national security. It’s about revenue replacement.

Why China’s Playing a Smarter Game

China isn’t scaling recklessly. It’s scaling strategically—and efficiently.

China vs U.S. (AI Infrastructure Head-to-Head):

- Electricity production: China 9,000+ TWh vs. U.S. ~4,200 TWh

- Industrial power cost: China ~$0.088/kWh vs. U.S. $0.12–$0.25

- Model strategy: China: lean, open-source | U.S.: massive, proprietary

Sanctions forced Chinese developers to adapt. Models like DeepSeek and ChatGLM:

- Use fewer parameters

- Run on cheaper, domestic hardware

- Consume up to 80% less energy

Constraint bred resilience.

Bans, Bailouts, and the Boardroom Playbook

This isn’t the first time Silicon Valley reframed competition as a threat.

The precedent: Meta vs. TikTok

- Failed to compete

- Cited “national security”

- Lobbied for bans

The repeat:

- OpenAI struggles with monetization → seeks public backing

- Nvidia loses China → seeks subsidies

- Chinese models succeed → branded as security risks

It’s not about leadership. It’s about margin defense.

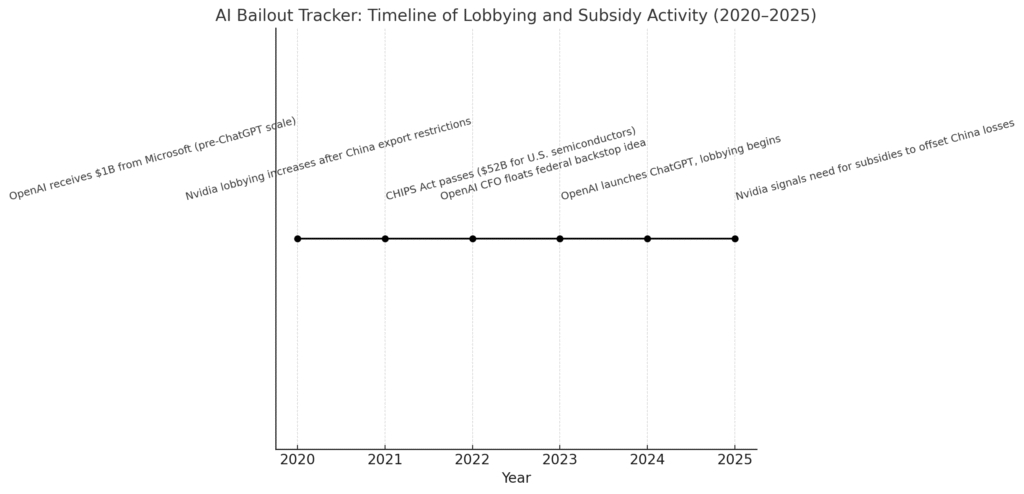

AI Bailout Tracker (2020–2025)

- 2020: Microsoft invests $1B in OpenAI

- 2021: Nvidia lobbying intensifies post-China restrictions

- 2022: CHIPS Act passed ($52B semiconductor subsidies)

- 2023: OpenAI CFO floats federal backstop idea

- 2024: OpenAI deepens lobbying footprint

- 2025: Nvidia requests further subsidy to offset export losses

What Happens If It Unravels?

- Grid pressure: A 300 MW data center = 225,000 homes worth of power [Washington Post]

- Market correction: 30% drop could erase $3–5 trillion in equity

- Global shift: China’s infrastructure-first model gains edge

The risk isn’t just overbuilding. It’s systemic collapse.

No More Blank Checks

The AI revolution is real. The economics are broken.

Tech giants want:

- Profits on the way up

- Public safety nets on the way down

What should we do instead?

- Upgrade U.S. grid infrastructure

- Democratize compute access

- Fund transparent, open innovation

If we don’t, the next crash won’t just be digital. It’ll be economic—and geopolitical.

Investor Risk Snapshot

| Metric | Status |

|---|---|

| AI capex vs. revenue | 70:1 |

| China power cost advantage | 3–4× cheaper |

| U.S. data center delays | 3–5 years average |

Join the Conversation

Agree? Disagree? Think taxpayers should underwrite AI infrastructure?

Share your view below

Related Reads:

- https://www.linkedin.com/pulse/14-trillion-ai-boom-already-bust-why-openai-nvidia-us-schulenberg-a8khe

- https://medium.com/systemic-reckonings/is-the-1-4-trillion-ai-boom-already-a-bust-8c76eec20c43

- https://open.substack.com/pub/sysreckonings/p/is-the-14-trillion-ai-boom-already?r=54ndmc&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

Subscribe for insights on AI, infrastructure, and economic shifts.